pay ohio property taxes online

Its fast easy secure and your. Make a debitcredit or eCheck payment online.

Cuyahoga County Property Tax Deadline Pushed Back To Feb 10 Wkyc Com

Payments by Electronic Check or CreditDebit Card.

. Monthly Budget Pay Plan. Several options are available for paying your Ohio andor school district income tax. The second half will be due by March 31st.

To view your tax bill or make a payment use a search option below. Pay Ohio Property Taxes Online On time. Please note payments will be.

Check back in the future as we hope to provide even more payment options online. Several options are available for paying your Ohio andor school district income tax. To research your taxes and pay online click here.

There is a convenience fee for making an online. Online Property Tax Payment Enter a search argument and select the search. For general payment questions call us toll-free at 1-800.

For creditdebit card or eCheck payment by phone call 1-866-288-9803. If you have questions regarding this expanded payment. Reducing Your Taxes.

Pay by Phone Make a secure payment by phone anytime 247. Makes it easy to pay Ohio property taxes using your favorite debit or credit card. Call 877 495-2729 Or pay online by clicking the link below.

Point Pay charges 100 per electronic check payment. Debit-card fees are a flat 350. Payments by Electronic Check or CreditDebit Card.

Real Property Tax Rates. You can pay your property taxes in-person during those hours using cash personal check creditdebit. If you have a mortgage your lender may also pay your property taxes for you as part of your escrow account.

Pay Online Please allow. Use your landline or mobile device to pay using our automated system by calling. Summit County Fiscal Office Kristen M.

Treasurers Association of Ohio. Minimum Convenience Fee for Tax. You can now pay your Columbiana County Ohio Property Taxes electronically.

The county website has more information on payment options and how to. This fee is in no way charged by the Hamilton County Treasurers Office. No Credit Card payments will be accepted by mail.

Ohio County Sheriffs Tax Office 1500 Chapline St. To 500 pm except holidays. BILLS MAILED June 10 2022 -DUE DATE July 8 2022.

Owner Occupancy Credit. Below are a few payments that can be made online for your convenience. Please follow the links below to learn more about ways to pay current taxes.

For residents with more than one. Search by parcel number or street address to narrow down your results. Our office is open Monday Friday 800 am.

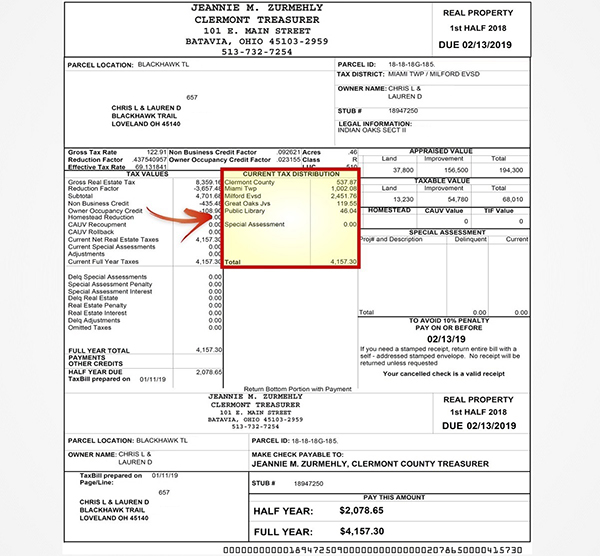

The CLERMONT COUNTY TREASURERS OFFICE offers taxpayers the opportunity to utilize the How to Pay options. For general payment questions call us toll-free at 1-800. This is a service through our on line provider Value Payment Systems.

Starting August 9 2022 the Ohio Department of Taxation ODT will begin mailing non-remittance billing notices to taxpayers who have not paid in full their 2021 Ohio individual andor school. Convenience fees for credit card transactions Visa MasterCard Discover and American Express are 230 of the total transaction or a 200 minimum. Box 188 Wheeling WV 26003 304 234-3688.

Skip to Resources Section Paying Your Taxes.

Sales Taxes In The United States Wikipedia

Software Systems Inc Property Tax Inquiry

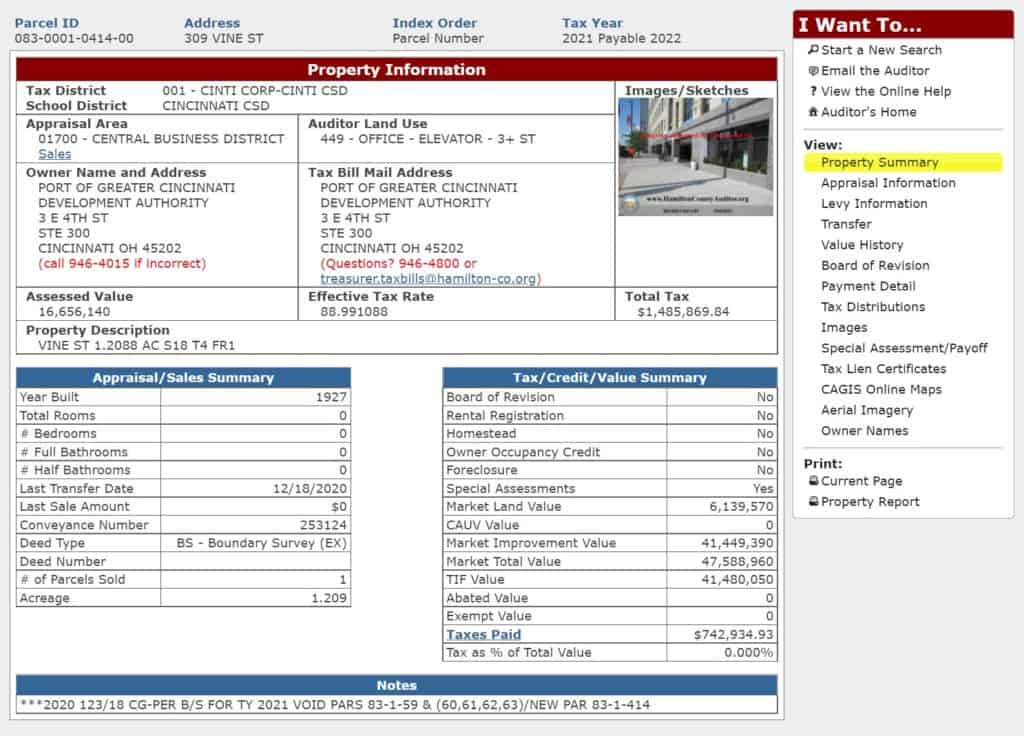

Hamilton County Ohio Property Tax 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Property Tax Calculator Smartasset

Payments By Electronic Check Or Credit Debit Card Department Of Taxation

New Portal Makes It Easier To Pay Cuyahoga County Tax Bills Online Cleveland Com

Pay Online Department Of Taxation

Understanding Your Tax Bill Clermont County Auditor

Franklin County Treasurer Home

Payment Options Treasurer Official Mercer County Ohio Government Website

Property Tax Calculator Smartasset

Pay Online Department Of Taxation

The Average Amount People Pay In Property Taxes In Every Us State

New Portal Makes It Easier To Pay Cuyahoga County Tax Bills Online Cleveland Com